5 Revelations from DEI-Focused PRSA Foundation’s Latest IRS Tax Filing

With a $300,000 loss at the Diversity Action Alliance, PRSA members deserve to know what their own Foundation "charity" is really doing on DEI.

It’s the season of giving, but as any charitable donor knows, it’s important to do your homework before blindly handing over money to any not-for-profit.

At a minimum here in the United States, reviewing an organization’s most recent Form 990 tax filing via the U.S. Internal Revenue Service (IRS) — alongside any other “annual report” made available by the philanthropy to cross-reference mission-driven accomplishments with claims of financial stability — should occur before granting any sizable charitable gift.

In the PR industry — unless you’re giving to your collegiate alma mater’s PR program — the choices of philanthropies in service to the profession are limited.

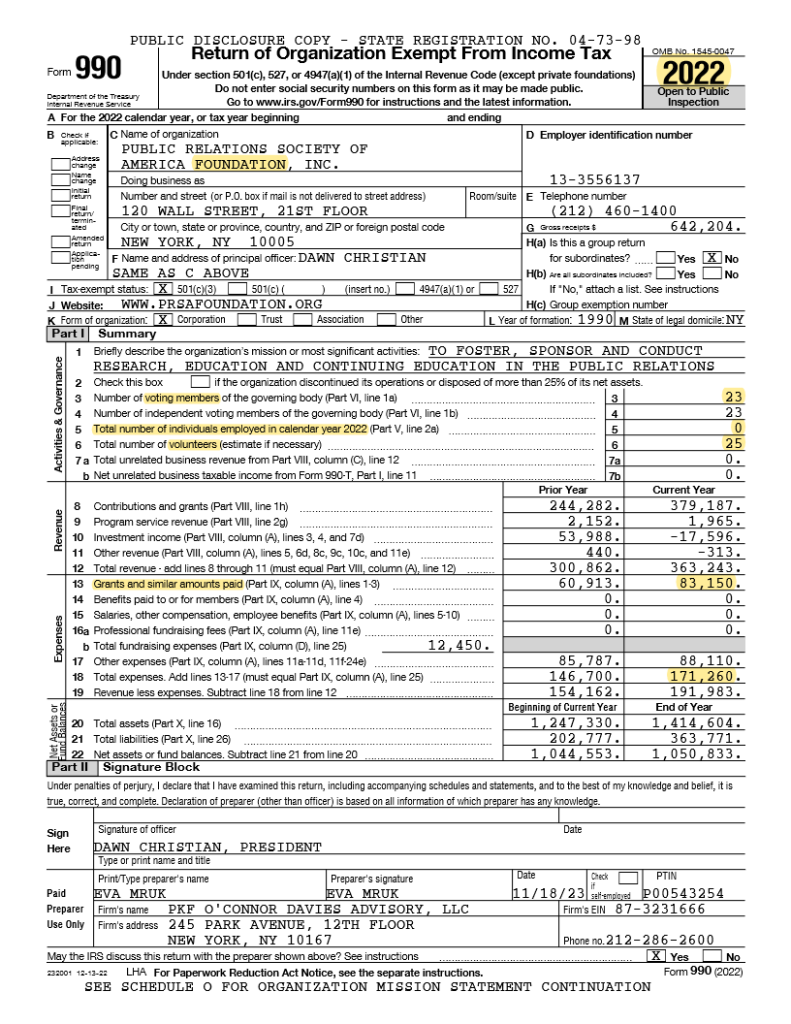

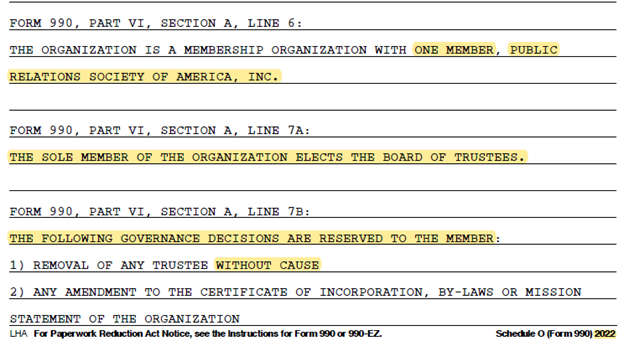

The PRSA Foundation is the “charity” arm of its “sole member” organization, the Public Relations Society of America, Inc. (PRSA) – itself a separate tax-exempt business league that’s supposed to promote the economic interests of the entire U.S. PR industry workforce (although only some 18,000 of the full U.S. PR industry’s some 300,000+ workers opt to join PRSA in this unregulated sector).

Both organizations share the same office space and staff on Wall Street in New York.

Like the PRSA business league, the PRSA Foundation charity (which has the same CFO and third-party auditor as PRSA, Inc.) always files an IRS Form 990 reporting deadline extension, deep into every year, to delay having to reveal publicly its prior year’s financials.

This defer-and-delay practice makes a statement all its own about how seriously either organization’s board or staff takes disclosure and transparency.

It also begs the question of what, precisely, are they trying to hide?

Now that we (finally) have the 2022 tax year filing in hand as of December 2023, we can compare and contrast where the PRSA Foundation stands on a host of serious issues tied to its stated mission-delivery and financial solvency.

Past years’ performances on both accounts have been brought into serious question within the numbers that the PRSA Foundation and PRSA each have reported to the IRS… versus what gets reported to PRSA members during the regular course of any given fiscal year.

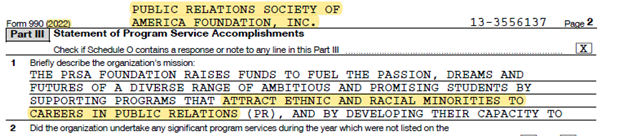

The PRSA Foundation claims as its reason for existence to “attract ethnic and racial minorities to careers in public relations.”

Seems clear.

But look more closely — while cross-referencing facts from other organizations that PRSA is quietly propping up — and a different picture emerges.

- You paid him WHAT?!?!

Rule No. 1 in donor relations:

Don’t ever make it look like you’re squandering money or enriching people on your payroll or on your board, at the expense of the “charitable” mission.

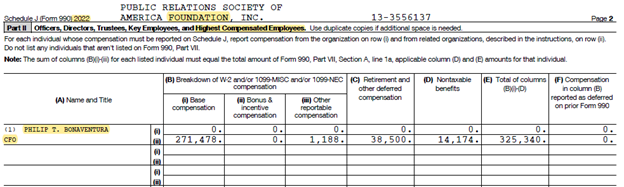

If your “charitable” Foundation claims 0 (zero) employees on Page 1 of its Form 990, but… back on Page 40 of that same document, it’s suddenly revealed that only one person on the Foundation’s watch (a white man, incidentally… which is primarily relevant given the postured mission of the PRSA Foundation) collected $325,340 in personal compensation – about $38,000 shy of the Foundation’s 2022 ‘Total Revenue’ line item – then you might have a donor-confidence problem.

Even if CFO Phil Bonaventura is more PRSA’s payroll problem than the Foundation’s, it’s a bad look. Either way, the situation appears to go unexplained in the filed tax documents.

2. Where is the PRSA Foundation’s money going?

The PRSA Foundation’s percentage of expenses dedicated to its stated mission of “grants and similar amounts paid” (such as for scholarships) is – for the fifth year in a row – LESS THAN 50% of all expenses generated by the Foundation.

For those unfamiliar with how charitable foundations are supposed to function:

The duty of any IRS-tax-exempt charitable foundation in the United States is to give money / resources away in service to its mission.

This reality always begs the question:

If you’re not spending a majority of your charitable expenses on mission-driven work, then what on earth are you spending it on?

If the answer to that question is widely undiscernible from your IRS tax filing – and if you fully opt out of publishing an annual narrative report to help explain things to your stakeholders – then it’s a big problem.

The Charity Navigator standard is that 70% of expenses should be directly spent on mission / programs / grants, while the Better Business Bureau’s recommendation is 65% or higher.

The PRSA Foundation’s mission-expense ratio of below 50% sends a troubling message to donors.

For the record, the PRSA Foundation’s past five years of stats on percentage of Foundation expense devoted to grants and scholarships have included:

2018: 20%

2019: 23%

2020: 24%

2021: 41%

2022: 48%

While it’s good to see the PRSA Foundation’s percentage at least trending in the right direction, the question looms large:

What in the world were they doing in 2018, 2019, and 2020, with less than 25% of expenses spent on grants and scholarships?

Bear in mind that 2018 and 2019 weren’t even pandemic years – so they can’t fall back on that tired excuse.

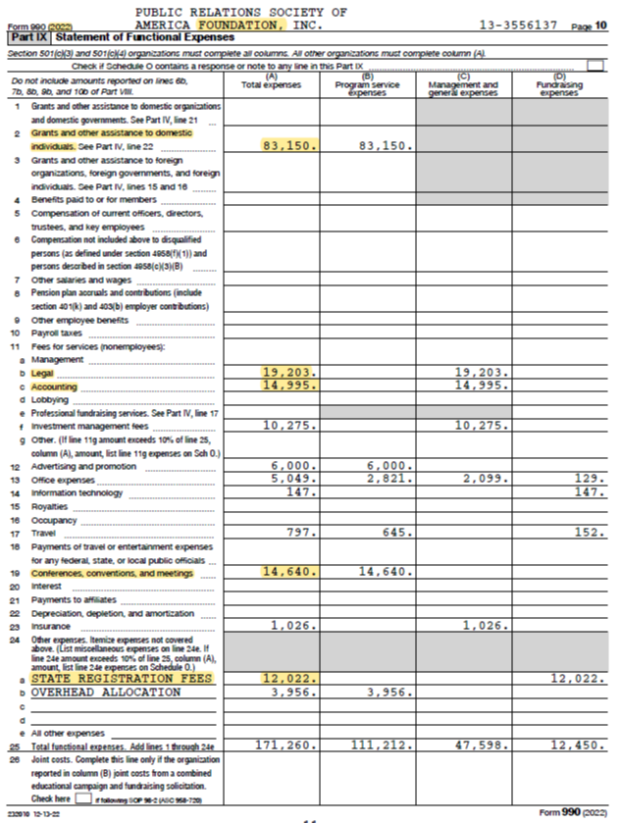

If you take a look at the PRSA Foundation’s “statement of functional expenses” in 2022, you’ll notice that “grants and assistance to domestic individuals was $83,150.

But the Foundation incurred $88,110 in other additional expenses simply to distribute that lesser amount in service to its mission, including:

$19,203 in “legal” (What have been their legal problems to justify this expense? For the sake of comparison, the Page Society — which employs 34 people — achieved gross receipts in 2021 of some $5.4 million but incurred about $4,000 less in “legal” expense than the PRSA Foundation in 2022, which claims technically to employ no one and earns a pie-sliver fraction of gross receipts).

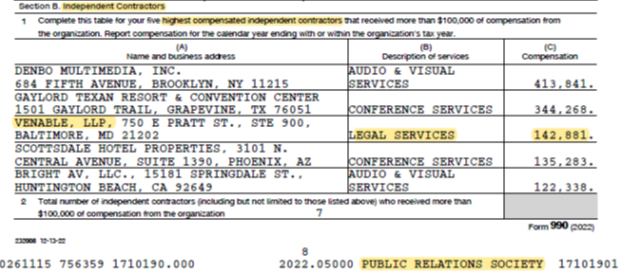

And as a footnote, the PRSA, Inc., business league apparently has so many legal problems that it listed in its own IRS 990 filing for 2022 its law firm of record — Venable, LLP — as its third-most highly compensated “contractor”… only behind its International Conference (#PRSAICON) audio-visual provider and hotel venue. (In 2021, Venable ranked #1, with $151,574 in legal services billings to PRSA, Inc.):

$14,995 in “accounting”

$14,640 in “meetings” (The PRSA Foundation does not host a “conference” or a “convention”… so what are they “meeting” about?)

$12,022 in purported “STATE REGISTRATION FEES,” which is particularly curious, since the New York Attorney General Charities Bureau filing fee is less than $1,000.

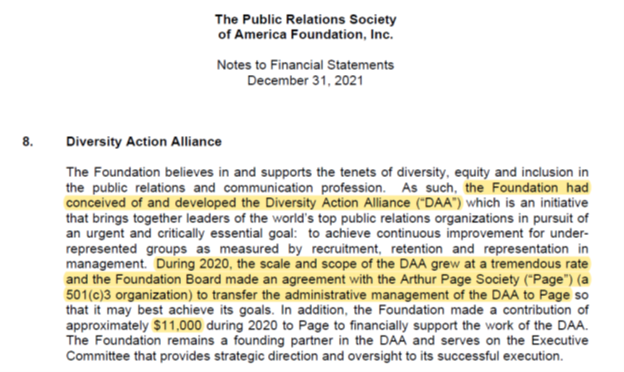

What’s more, back in 2021, the PRSA Foundation forked over $11,000 down the rabbit hole know as the aforementioned “Diversity Action Alliance,” or DAA (and who knows how much more money in years since).

The PRSA Foundation subcontracted out their DAA idea — which, itself, was a subcontract-out of PRSA’s own “diversity” obligation — to Page (formerly known as the Arthur Page Society).

The PRSA Foundation claims sole credit in its 2021 Audit Report “Notes to Financial Statements” that it “conceived of and developed” the DAA itself.

So… to the victor go the spoils… but — spoiler alert! — in this case, said spoils amount to one big, fat, negative dowry — at least for Page.

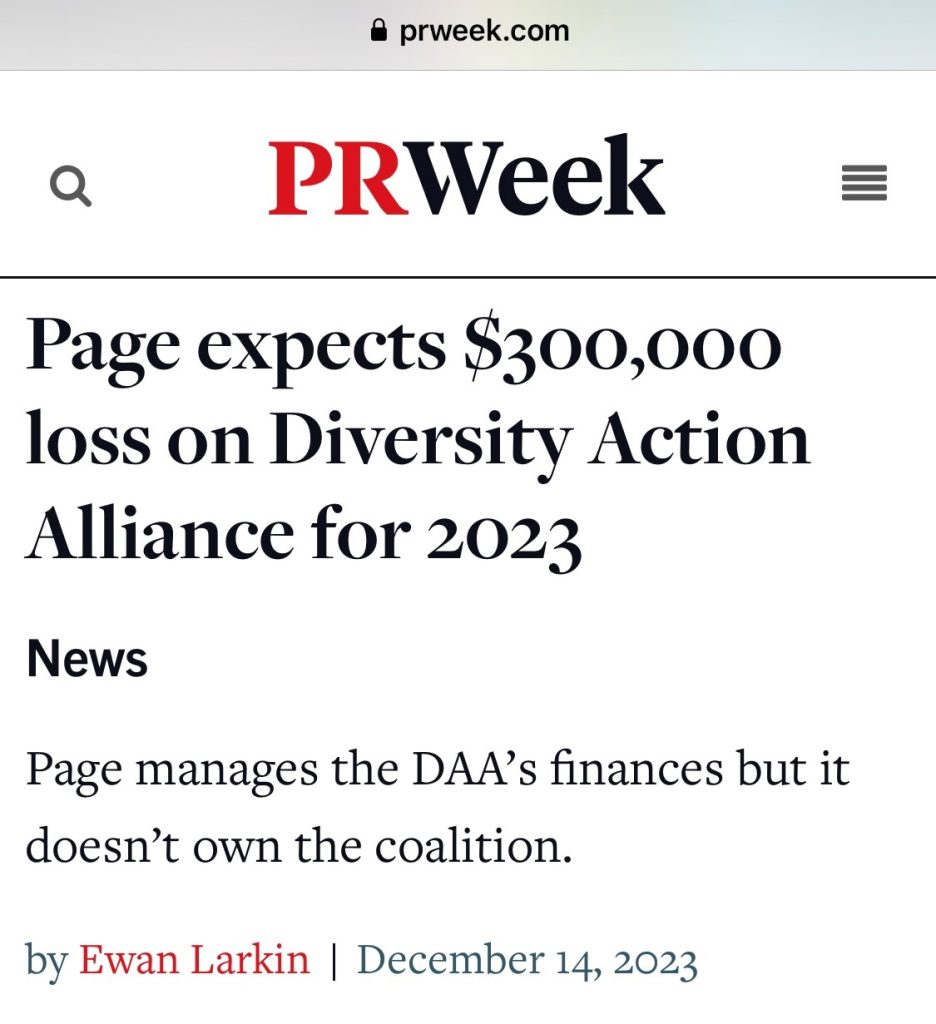

A new PRWeek article just last week (Dec. 14, 2023) revealed the DAA is now expected by Page to lose $300,000 for 2023.

So much for a return on investment!

Two PRSA, Inc. executives – the CEO (Linda Thomas Brooks) and CFO (the arguably overpaid Bonaventura) – serve on the governing Board of the DAA, too.

For that very reason, accountability by PRSA for such deep financial losses is not likely.

Per PRWeek, the executive at Page who bears the burden of housing the DAA and processes the DAA director’s payroll blamed the $300K loss on the “business model,” but not on the PRSA Foundation that “conceived of and developed” it by themselves.

With no accountability, everyone comes out smelling like a rose, except for dwindling donors, who keep forking over money on the annual false promise of seeing real value in diverse workforce recruitment and advancement, which doesn’t appear to be accelerating to anyone’s liking.

To quote DAA Board Member and Lagrant Foundation CEO Mr. Kim Hunter’s level of disenchantment as noted in reporting by PRWeek, “…[The repeal of] affirmative action is going to have little impact on the PR agency world because they never did sh*t to begin with.” <expletive deleted>

That’s quite an indictment.

3. Who’s footing the ultimate bill here? PRSA dues-paying members, that’s who.

It’s a colossal case of throwing good money after bad.

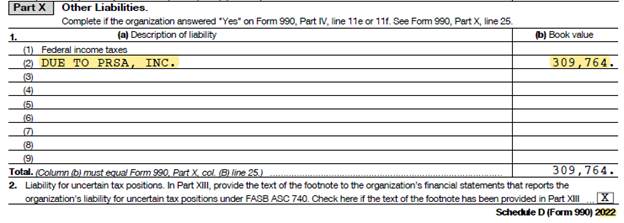

The PRSA Foundation’s “other liabilities” amount “Due to PRSA, Inc.” skyrocketed from $157,537 in 2021 to $309,764 in 2022, according to the latest 990.

It’s certainly interesting how close this amount is to the $300,000 loss now reported at the DAA, or, alternatively, how close this amount is to the arguably overpaid white male CFO’s annual compensation.

Can a forensic accountant please step forward?

We’re left to infer that the PRSA Inc. business league is pumping “loaned” member dollars like crazy into the PRSA Foundation, to prop it up, á la “Weekend at Bernie’s.”

Why? Because the PRSA Foundation cannot sustain itself.

This siphoning of PRSA business league member treasure into an entity that serves very few people is occurring without the members’ advance knowledge or permission, mind you.

PRSA executive staff and their boards (on either the business league side or the charity side) don’t want PRSA dues-paying members knowing what’s going on or asking questions. It’s all about keeping appearances afloat, artificially.

Since the PRSA Foundation hasn’t bothered to publish an annual report for PRSA members, donors, or the general public to see since 2020 (except for its always-belated tax filing), no one is allowed to know what this train-wreck is all about in any narrative explanation.

Again, not a good reality if you’re trying to project long-term viability of your charity and earn people’s trust.

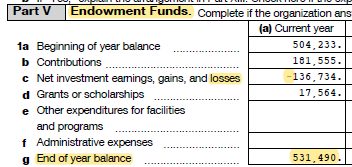

4. After 33 years in business, the PRSA Foundation only has an endowment fund balance worth half-a-mill.

Such a paltry fund balance is fall-out-of-your-chair bad.

Founded in 1990, the PRSA Foundation has claimed a 2022 end of year endowment balance of $531,490. The interest earned from that modest amount to fund much of anything on a sustained basis is extraordinarily weak.

They should have an endowment worth millions by now. They have no good excuse not to.

The PRSA Foundation is – after all – a national foundation for a national professional organization. It’s not some local-yokel start-up with no urgency to manage real expectations – although for reasons that mystify everyone, they insist on behaving like one.

The endowment balance is particularly weak considering that the PRSA Foundation’s board members – 23 of them – don’t appear to be pulling much weight in the category of roll-up-your-sleeves fundraising… making phone calls, soliciting peers, actively using their social media to promote “Giving Tuesday” for the Foundation or similar campaigns, and similar efforts.

Their board includes the corporate likes of companies such as The Home Depot, Uber, and Amazon. So what gives? Or rather, WHO gives?

Yet again, the public isn’t allowed to know.

The PRSA Foundation won’t disclose their donors’ identities in any form of customary “appreciation” listing – with donors grouped together at various annual giving levels, as is customary in most charities’ non-profit reports. A way-out-of-date donor listing appears here on line… so out of date, in fact, that it even lists MY name.

To that point, what is board members’ own donor participation level? 100%? 50%? 5%?

Most external donors want to know — and quite frankly, deserve to know — if a board of directors is financially vested. This isn’t an outlandish disclosure request… except, apparently, in PRSA.

The Foundation only counted six contributors worthy of mentioning on its 2022 Form 990 filing.

While the first gift listed is sizable by PRSA Foundation standards ($157,095), it’s quite possible this gift came from the PRSA Inc. business league itself (translated: member dollars, without notification to or knowledge by the members). This amount would help explain the jump in the “Due to PRSA” liability balance ticking up as it did from what was documented earlier in 2021.

If PRSA CFO Phil Bonaventura had taken that massive salary he earns and applied it toward any stewardship toward transparency, he would have listed from whom the Foundation’s only 2022 six-figure gift came.

But he didn’t. Instead, secrecy reigns. And why is that?

Further, in the Foundation’s own 990 filing, they spill the beans that PRSA Inc. can fire PRSA Foundation charity board members “without cause.”

For all their other non-disclosures, those particular two words send a very ominous message, loud and clear.

This retaliatory warning doesn’t exactly encourage a “Speak up!” culture on the Foundation board for any perceived “troublemakers” to tell PRSA with any honesty all the things they’re doing wrong or unethically.

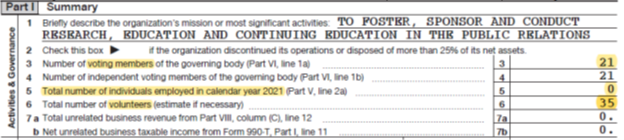

5. Speaking of Board members and volunteers – what exactly happened last year?

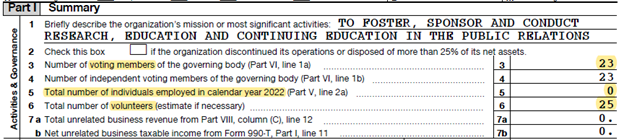

The PRSA Foundation gained two board members but somehow ran off 10 volunteers in 2022, compared with 2021.

In 2021, the Foundation’s 990 filing claimed 21 Board members and 35 volunteers.

In 2022, the 990 filing claims 23 Board members and 25 volunteers.

I’m going to presume at this point that all the people who are “voting members of the governing board” are ALSO the “volunteers.”

Fewer people acting as “volunteers” certainly helps keep nosy, pesky questions at bay, like – “Where’s the money going?”

Lost Potential

The PRSA Foundation could be raising serious money (“serious” meaning millions) and doing things that help the entire industry be economically successful… such as research and scholarship centered on universal issues like ethics, AI’s impact on the PR industry, or new data-driven rationales to enhance PR’s perceived value and relevance within corporate boards of directors.

But no.

A group of folks all got in a metaphorical smoke-filled room about 10 years ago and decided arbitrarily – with no research conducted of donor support or expectations, nor even with one measurable objective set – to make the Foundation’s focus exceptionally narrow, and, in this day and age, hotly politicized.

Has the strategy worked?

I’m sure if you ask the less than 250 current and former students who’ve received mostly modest scholarships (under $1,500-2,000) over the past 10 years, they will agree they personally benefitted and will express appreciation… which is, of course, nice – at least for them.

But that’s 250 people out of – what? – 10,000-15,000+ students who’ve tried to participate in PRSSA overall during that same 10-year timeframe.

How have those thousands been helped?

Further, how can 250 students who did benefit translate into the the DEI “systemic change” that was promised to the U.S. PR industry, a decade ago? 250 people within a national PR workforce well into many hundreds of thousands isn’t even a drop in the systemic bucket.

Is the fact that students aren’t being supported adequately or universally by PRSA the reason why PRSSA student membership slid by more than 40% over this same 10-year timeframe?

Earlier this year, the U.S. Supreme Court struck down as unconstitutional racially based college admissions, and many states and higher-ed institutions are following suit to disallow the very types of race-based scholarships the PRSA Foundation now focuses on almost solely.

As for myself, I’ve consciously chosen to work toward systemic change in my own local market… by collaborating with a wide range of secondary and higher education leaders outside the PR industry, who know how to operate organically and effectively within an existing student-to-workforce ecosystem.

Have updated approaches even been addressed in the PRSA Foundation boardroom?

Guess we’ll only be allowed to find out what happened this year, in December of… next year.